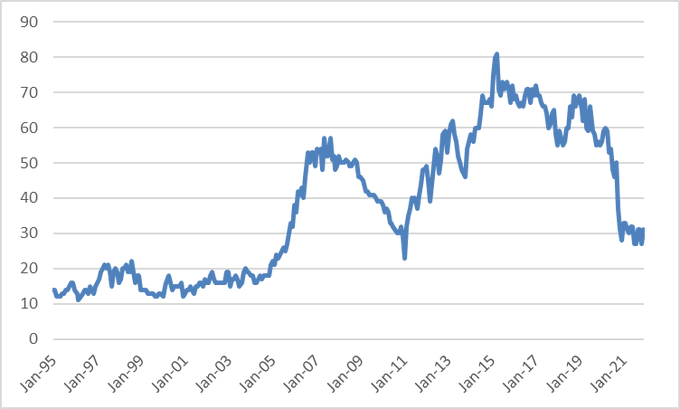

Oil above $80....every day above $70 is a great day!

2022 Information

January 31st WTI settled at $88.15 (Front month Mar 2022)

March 2022 contracts expire February 18th, 2022.

March 2022 contracts 40.0% complete

1st Quarter 2022 WTI Pricing now 80.4%complete! (If the last 18 days of Q1 is at or above $73.25 we will beat the Q4 WTI average)

1st Half 2022 WTI Pricing now 40.7% complete! (If the next 108 days of 1H is at or above $65.35 we will hit a $70 average for 1H which was the key to getting to $1.2B debt)

2022

Q1 2022 BTE Cash Flow AFF Q1 = $TBD avg $76.68 (PRIOR YEAR $52.09)

2021

Q1 2021 BTE Cash Flow AFF Q1 = $157M avg WTI $52.09

Q2 2021 BTE Cash Flow AFF Q2 = $176M avg WTI $62.71

Q3 2021 BTE Cash Flow AFF Q3 = $198M avg WTI $70.57

Q4 2021 BTE Cash Flow AFF Q4 = $TBD avg WTI $76.04

Full Year 2021 WTI $65.34 FINAL!